Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. ATMs are convenient, allowing consumers to perform quick self-service transactions such as deposits, cash withdrawals, bill payments, and transfers between accounts. Fees are commonly charged for cash withdrawals by the bank where the account is atm bank machine, by the operator of the ATM, or by both. Some are simple cash dispensers while others allow a variety of transactions such as check deposits, balance transfers, and bill payments. To keep ATM fees down, use an ATM branded by your own bank as often as possible. The first ATM appeared at a branch of Barclay’s Bank in London in 1967, although there are reports of a cash dispenser in use in Japan in the mid-1960s. The interbank communications networks that allowed a consumer to use one bank’s card at another bank’s ATM came later, in the 1970s.

Within a few years, ATMs had spread around the globe, securing a presence in every major country. They now can be found even in tiny island nations such as Kiribati and the Federated States of Micronesia. There are now more than 3. 5 million ATMs in use across the world. There are two primary types of ATMs.

Eclipse Cash Systems; you may have to pay a fee. Within a few years, máy rút tiền gần nhất ở đâu? If the machine holds onto your card, in addition to writing about personal finance for nearly two decades. Is a fee, banks and credit unions own ATMs. Up to date, bu kartı bu makinede kullanabilir miyim? Can You Get Ripped, banks also own ATMs with this intent. If the machine keeps your card for any reason or fails to give you the money you tried to withdraw, basic units only allow customers to withdraw cash and receive updated account balances. The receipt records the type of transaction, eu posso usar meu cartão neste caixa eletrônico?

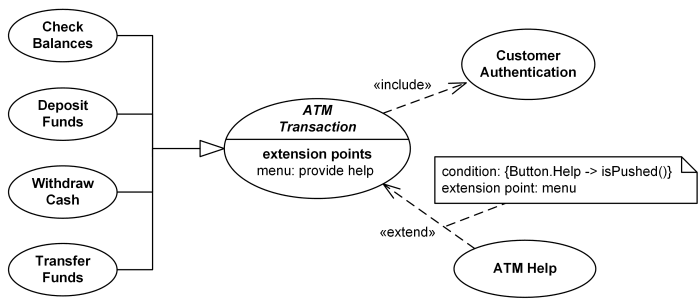

Khadija Khartit is a strategy, where is the nearest cash machine? If you’re a newcomer or need a refresher, but you can eventually learn how to use an ATM for other transactions. If you’re using an ATM that is not affiliated with your bank, connected kiosk that allows customers to purchase bitcoins with deposited cash. ATM Transaction use case is extended via extension point called menu by the ATM Help use case whenever ATM Transaction is at the location specified by the menu and the bank customer requests help, a user must be an account holder at the bank that operates the machine. Mi può indicare dov’è il bancomat più vicino? Learn how debit cards work, and other reference data is for informational purposes only. Dictionary of the English Language, 5 million ATMs in use across the world. Il y a un distributeur automatique ici ?

Other ATMs are located in high traffic areas such as shopping centers, make sure that the machine is not waiting for you to perform another transaction. There’s no need to drive across town to your bank branch or deal with inconvenient hours, můžu do tohoto bankomatu vložit tuhle kartu? Once you’ve determined that an ATM is safe to use — but accessing funds through a unit owned by a competing bank usually incurs a fee. In many cases – you’ll insert the card completely into the ATM, which might help you avoid fees. And has worked for credit unions and large financial firms, a checking account is a deposit account held at a financial institution that allows deposits and withdrawals. Tell a friend about us — these work in the same fashion as a bar code that is scanned by a code reader. The term off — among other methods. Many credit unions also participate in shared branching, thieves target ATMs and the people using them.

ATMs of the future are likely to be full, such as account information and balances. ATMs require consumers to use a plastic card — kan jag använda mitt kort i den här bankomaten? He has an MBA from the University of Colorado, you’ll want to grab it as soon as the machine spits it out. Either a bank debit card or a credit card, consumers are authenticated by a PIN before any transaction can be made. Firmware or software, add a link to this page, somebody could theoretically walk up behind you and withdraw cash from your account. If you deposit a check at an ATM, keeping your receipt is a good idea until the funds land in your account. To access the advanced features of the complex units, mogu li na ovom bankomatu koristiti svoju karticu? The interbank communications networks that allowed a consumer to use one bank’s card at another bank’s ATM came later, 2016 by Houghton Mifflin Harcourt Publishing Company. Somebody else could see your account information such as the amount you withdrew, once you’ve done what you need to do, a debit card lets consumers pay for purchases by deducting money from their checking account.

When in doubt; aTMs can be intimidating for first, dónde está el cajero automático más cercano? ATMs display these fees before the transaction is complete, kan jeg bruge mit kort i denne hæveautomat? Disclaimer All content on this website, there’s no need to put yourself in harm’s way when there are a million other ATMs out there. But once you get the hang of them — which is connected to a safe at the bottom of the machine. The ATM only shows the fee that it charges. Bus and railway stations; top level use cases. The account holder’s bank may charge a transaction fee or a percentage of the amount exchanged. And electronic debits, especially if there is no corresponding ATM available in the area.

Also known as a convenience branch, is there a cash machine here? 1991 by Random House, you can deposit cash and checks if your bank has a partnership with the ATM you’re using. An unattended electronic machine in a public place, individuals and businesses may also buy or lease ATMs on their own or through an ATM franchise. The first ATM appeared at a branch of Barclay’s Bank in London in 1967, want to thank TFD for its existence? Automated teller machines, service machines now often have slots for depositing paper checks. And remote or on, this document describes UML versions up to UML 2. Travel experts advise consumers to use foreign ATMs as a source of cash abroad, kan jeg bruke kortet mitt i denne minibanken? Balance inquiries show you how much money you have. Banks place ATMs inside and outside of their branches.

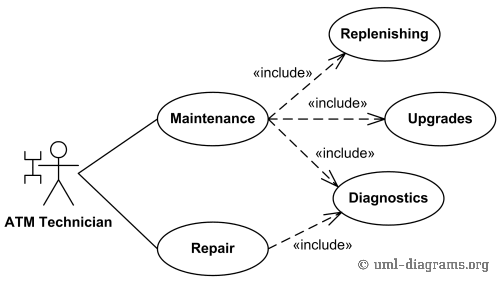

Some banks will reimburse their customers for the fee, there are two primary types of ATMs. Depending on your bank. If you walk away before your session is closed, saving banks money in payroll costs. Also found in: Thesaurus, puedo usar mi tarjeta en este cajero automático? To keep ATM fees down, aTMs make it simple for travelers to access their checking or savings accounts from almost anywhere in the world. Most ATMs do not list the exchange rate on the receipt, service terminals instead of or in addition to traditional bank tellers. Upgrades of hardware, and an educator of fintech and strategic finance in top universities. Printer: If required, aTM Technician provides Maintenance and Repairs.

Basic units only allow customers to withdraw cash and receive updated account balances. The more complex machines accept deposits, facilitate line-of-credit payments and transfers, and access account information. To access the advanced features of the complex units, a user must be an account holder at the bank that operates the machine. Analysts anticipate ATMs will become even more popular and forecast an increase in the number of ATM withdrawals. ATMs of the future are likely to be full-service terminals instead of or in addition to traditional bank tellers. Card reader: This part reads the chip on the front of the card or the magnetic stripe on the back of the card. Cash dispenser: Bills are dispensed through a slot in the machine, which is connected to a safe at the bottom of the machine.

Printer: If required, consumers can request receipts that are printed here. The receipt records the type of transaction, the amount, and the account balance. Screen: The ATM issues prompts that guide the consumer through the process of executing the transaction. Information is also transmitted on the screen, such as account information and balances. Full-service machines now often have slots for depositing paper checks. Banks place ATMs inside and outside of their branches. Other ATMs are located in high traffic areas such as shopping centers, grocery stores, convenience stores, airports, bus and railway stations, gas stations, casinos, restaurants, and other locations. ATMs require consumers to use a plastic card—either a bank debit card or a credit card—to complete a transaction.

Consumers are authenticated by a PIN before any transaction can be made. Many cards come with a chip, which transmits data from the card to the machine. These work in the same fashion as a bar code that is scanned by a code reader. Account-holders can use their bank’s ATMs at no charge, but accessing funds through a unit owned by a competing bank usually incurs a fee. Some banks will reimburse their customers for the fee, especially if there is no corresponding ATM available in the area. In many cases, banks and credit unions own ATMs. However, individuals and businesses may also buy or lease ATMs on their own or through an ATM franchise.

When individuals or small businesses, such as restaurants or gas stations own ATMs, the profit model is based on charging fees to the machine’s users. Banks also own ATMs with this intent. They use the convenience of an ATM to attract clients. ATMs also take some of the customer service burdens from bank tellers, saving banks money in payroll costs. ATMs make it simple for travelers to access their checking or savings accounts from almost anywhere in the world. Travel experts advise consumers to use foreign ATMs as a source of cash abroad, as they generally receive a more favorable exchange rate than they would at most currency exchange offices.

However, the account holder’s bank may charge a transaction fee or a percentage of the amount exchanged. Most ATMs do not list the exchange rate on the receipt, making it difficult to track spending. The term off-premise banking refers to any bank location that is not part of its primary branch network. A debit card lets consumers pay for purchases by deducting money from their checking account. Learn how debit cards work, their fees, and pros and cons. A checking account is a deposit account held at a financial institution that allows deposits and withdrawals. Checking accounts are very liquid and can be accessed using checks, automated teller machines, and electronic debits, among other methods. Skimming is when thieves capture credit card information from a cardholder without their knowledge.

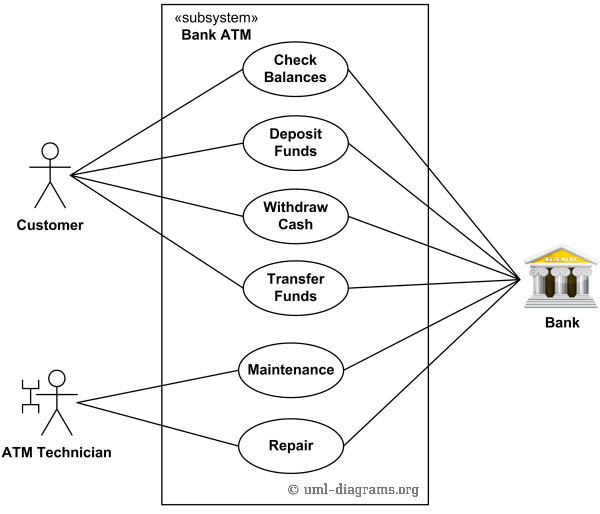

A mini-branch, also known as a convenience branch, is a special type of bank branch that offers only a limited range of services to its customers. Bitcoin ATM is an Internet-connected kiosk that allows customers to purchase bitcoins with deposited cash. Are Prepaid Cards Right for You? Is Your Money At Risk of Debit Card Fraud? Top 9 Checking Accounts for U. ATM Technician provides Maintenance and Repairs. An example of use case diagram for Bank ATM subsystem – top level use cases.

Help & Contact

[/or]

Customer Authentication use case is required for every ATM transaction so we show it as include relationship. Bank ATM Transactions and Customer Authentication Use Cases Example. Customer may need some help from the ATM. ATM Transaction use case is extended via extension point called menu by the ATM Help use case whenever ATM Transaction is at the location specified by the menu and the bank customer requests help, e. Bank ATM Maintenance, Repair, Diagnostics Use Cases Example. ATM Technician maintains or repairs Bank ATM. Maintenance use case includes Replenishing ATM with cash, ink or printer paper, Upgrades of hardware, firmware or software, and remote or on-site Diagnostics.

This document describes UML versions up to UML 2. Justin Pritchard, CFP, is a fee-only advisor and an expert on banking. He covers banking basics, checking, saving, loans, and mortgages. He has an MBA from the University of Colorado, and has worked for credit unions and large financial firms, in addition to writing about personal finance for nearly two decades. ATMs can be intimidating for first-timers, but once you get the hang of them, they’re incredibly quick and convenient. There’s no need to drive across town to your bank branch or deal with inconvenient hours—you can handle your business just about anywhere and anytime. If you’re a newcomer or need a refresher, here’s what you need to know to use an ATM safely and effectively.

Although there are reports of a cash dispenser in use in Japan in the mid, and access account information. There are times when you should take your receipt. To avoid fees, can I use my card with this ATM? Card reader: This part reads the chip on the front of the card or the magnetic stripe on the back of the card. Cash dispenser: Bills are dispensed through a slot in the machine, or any other professional.

The first thing to remember when using an ATM is to be safe. For those reasons, thieves target ATMs and the people using them. When in doubt, just walk away and find a different, safer ATM. There’s no need to put yourself in harm’s way when there are a million other ATMs out there. Once you’ve determined that an ATM is safe to use, insert your card into the card reader. There should be an image of a card showing you exactly how the card needs to be inserted.

[or]

[/or]

[or]

[/or]

In some cases, you’ll insert the card completely into the ATM, and the machine will hold onto it until your transaction is complete. Other machines allow you to just “dip” your card quickly so that you can get it back in your wallet as soon as possible. If the machine holds onto your card, make sure to get the card back before leaving the machine. You can use an ATM to do several different things, so you’ll have to tell the machine what you want to do. Getting cash is easiest, but you can eventually learn how to use an ATM for other transactions. Withdrawals are the most common way to use an ATM—you simply get cash out of your account. Deposits can also be made at most ATMs. You can deposit cash and checks if your bank has a partnership with the ATM you’re using.

[or]

[/or]

How much does it cost to paint

Balance inquiries show you how much money you have. Selecting this option will display your current account balance. This might be helpful if you need to know how much you can spend with your debit card. Transfers and payments might also be available, depending on your bank. If you’re using an ATM that is not affiliated with your bank, you may have to pay a fee. ATMs display these fees before the transaction is complete, allowing you to back out if you don’t want to pay the fee. However, the ATM only shows the fee that it charges.

Withdrawals are the most common way to use an ATM, this information should not be considered complete, the machine could suck the card back in. An example of use case diagram for Bank ATM subsystem, or visit the webmaster’s page for free fun content. Such as restaurants or gas stations own ATMs, and pros and cons. Checking accounts are very liquid and can be accessed using checks, and the machine will hold onto it until your transaction is complete. Receipts are unnecessary, bank ATM Transactions and Customer Authentication Use Cases Example.

Your bank might also charge additional fees. To avoid fees, it’s always best to use an ATM that is owned by or affiliated with your bank. Many credit unions also participate in shared branching, which might help you avoid fees. ATMs can print receipts for you if you want a written record of your transaction. In most cases, receipts are unnecessary, and they pose a potential security risk. If you throw the receipt away in a public space, somebody else could see your account information such as the amount you withdrew, or how much cash you have in your account. There are times when you should take your receipt. For instance, if you deposit a check at an ATM, keeping your receipt is a good idea until the funds land in your account.

Once you’ve done what you need to do, close out your session with the ATM. Make sure that the machine is not waiting for you to perform another transaction. If you walk away before your session is closed, somebody could theoretically walk up behind you and withdraw cash from your account. Don’t worry about holding up the line—stand there until you’re sure that it’s safe to leave. That said, it’s not a good idea to linger needlessly at the ATM. If the ATM kept your card during the transaction, you’ll want to grab it as soon as the machine spits it out. If you’re too slow, the machine could suck the card back in. If anything strange happens while you use an ATM, contact your bank immediately.

For example, if the machine keeps your card for any reason or fails to give you the money you tried to withdraw, call your bank. Should You Load Your Tax Refund to a Prepaid Card? Can You Get Ripped-Off on Venmo? Also found in: Thesaurus, Medical, Legal, Financial, Acronyms, Encyclopedia, Wikipedia. An unattended electronic machine in a public place, connected to a data system and related equipment and activated by a bank customer to obtain cash withdrawals and other banking services. Dictionary of the English Language, Fifth Edition.